WA Organics Industry: Opportunities, Challenges and Options

Get involved

About the project

Background

Our method

Themes

These are the themes that we are researching during our project.

The themes aren't exhaustive. As new issues come to light, we will add them as themes to investigate.

If you are making a written submission, you may like to address these themes.

If you are being interviewed, these are the types of questions we may ask you (but each interview is tailored to the person being interviewed).

Experiences with organic and biodynamic production

- How long have you been farming / producing

- For how much of that time have you been organic / biodynamic

- What was your motivation / what still motivates you

- How did you find the conversion process

- Dealing with nutrient deficiency - nitrogen / phosphorous

- Dealing with weeds and pests - experience with integrated weed & pest management

- If biodynamic, what is your view of the relationship with organic

- Do you have any regrets about being an organic / biodynamic producer

- Is your financial profitability higher compared with non-organic

Production experience

- Where does your production go (consumer ready/export/processors)

- How close to maximum capacity do you operate

- How much production is not sold / sources of wastage

- How could collaboration (industry or government) alleviate this

Constraints facing the business

- Consumer demand

- Farm gate prices

- Export markets

- Industry peak body support

- Industry regulation

- Certifier

- Agronomist

- Research & Development Corporation

- Competition from organic operators / non-organic operators

- Proximity to similar producer / transport / suppliers

Enablers needed by the business

- Consumer demand

- Farm gate prices

- Export markets

- Industry peak body support

- Industry regulation

- Certifier

- Agronomist

- Research & Development Corporation

- Collaboration with organic operators / non-organic operators

- Proximity to similar producer / transport / suppliers

Experience with the supply chain

- high level of vertical integration of WA farms

- on-farm processing

- value-adding processes

- distribution arrangements

- connection with retail

Any new opportunities for organic production in WA

- supply chain bottlenecks to overcome

- lack of processors / on-farm processing

- collaboration between organic operators

- export opportunities

- supermarket opportunities

Experience with supermarkets

- deal directly or through a distributor

- how to satisfy expected quality / reliability / quantity

- any wastage due to this arrangement

- packaging

- shelf space

- retail pricing / product price / margins

- what is the potential for substitution of imports from overseas / other States

Experience with exporting

- export logistics

- dealing directly / Australian handler / export country distributor

- satisfying expected quality / reliability / quantity

- transport / handling / logistic problems

- dealing with importing country regulatory requirements

- packaging

- shelf space

- retail pricing / product pricing / margins

- strategy

- engaging export-related service providers

- have an export marketing plan with defined targets and strategies

- reliable and up-to-date research about target markets

- current export markets

- market access issues

- which markets to target / where does market intelligence come from

- production issues

- staff dedicated to exporting / proportion of staff time devoted

- any wastage due to exporting

- exports turnover (proportion of total turnover)

Governments as constraints or enablers of business growth and industry growth

- how does WA Government enable your business

- access to grant programs

- supportive regulations

- export facilitation / market access assistance

- information services

- agronomy services

- how does the Australian Government enable your business

- how do governments act as constraints on your business

- WA Government

- Australian Government

- what is your experience with DPIRD

Sustainability

Do you think there is a significant difference between:

- organic and regenerative

- organic and sustainable

- organic and biodynamic

The Western Australia Department of Primary Industries and Regional Development has commissioned Policy Partners to review the indicators of maturity and quality of the Organic Industry in WA compared with benchmarks in other States.

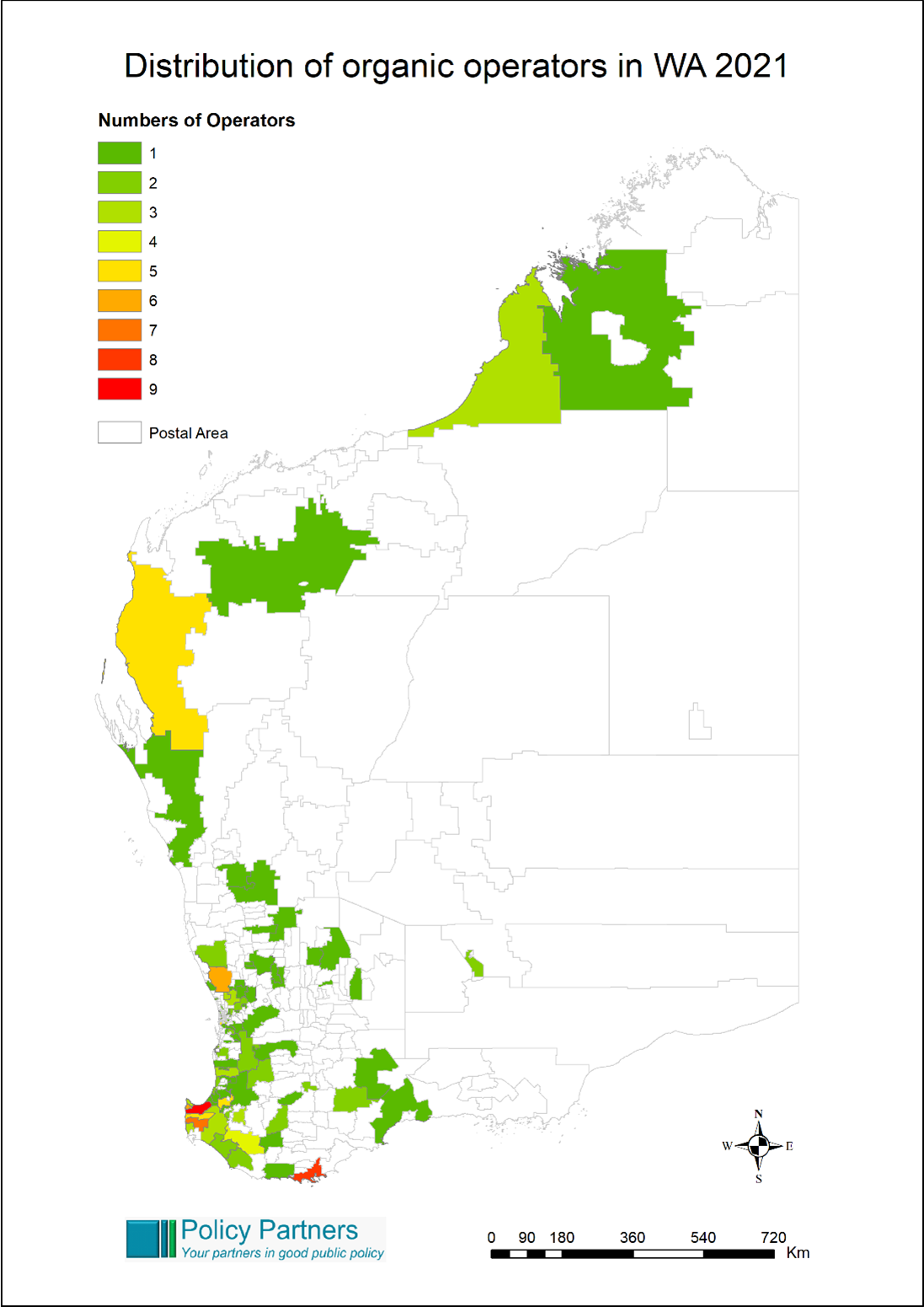

The Western Australia Department of Primary Industries and Regional Development has commissioned Policy Partners to review the indicators of maturity and quality of the Organic Industry in WA compared with benchmarks in other States. There are around 250 operators in Western Australia who have their production systems certified as organic or biodynamic. These producers are distributed across the State, but the vast majority of operators are located within the region bounded by Perth, Margaret River and Albany. They produce the full range of agricultural products, but using organic or biodynamic systems of production.

There are around 250 operators in Western Australia who have their production systems certified as organic or biodynamic. These producers are distributed across the State, but the vast majority of operators are located within the region bounded by Perth, Margaret River and Albany. They produce the full range of agricultural products, but using organic or biodynamic systems of production.